multistate tax commission allocation and apportionment regulations

In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General. As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of.

Memorandum To Multistate Tax Commission

Jan 15 - KPMG report.

. Sales of tangible personal property are subject to New York sales tax unless they are specifically exempt. USA February 28 2017. Multistate Tax Commission Adopts Income Apportionment Rules.

The Tax Departments Nonresident Audit Guidelines are more widely-known and available on the Tax Departments website Over the years however the Tax Department has. Multistate Tax Commission Allocation and Apportionment Regulations Adopted February 21 1973. Multistate Tax Commission Model General Allocation and Apportionment Regulations Current as of 2017 2 PREFATORY NOTES These prefatory notes and the drafters notes below are.

Page last reviewed or updated. Allocation and Apportionment Regulations. Gorrod analyzed the Model General Allocation and Apportionment Regulations.

The only exceptions to the allocation and apportionment rules contained in this rule are those set forth in sections 63- 66 of this rule under the authority of Article IV18. Rules for Real Property Tax Administration. Federal tax developments for 2020 as reported in TaxNewsFlash Jan 15 - KPMG report.

Final and proposed regulations passive. 1 See Resolution Adopting Amendments to the Multistate Tax Commissions Model General Allocation and Apportionment Regulations Special Meeting of the MTC February 24 2017 a. As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact.

Year-in-review list of US. Adopted February 21 1973. Pursuant to the Multistate Tax Compact Art.

21 Mar 2017. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General Allocation and Apportionment. Of the Multistate Tax.

Sales of services are generally exempt from New York sales tax unless. Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of Income for Tax Purposes Act The Allocation and Apportionment Regulations were adopted by the. 2 a and Commission Bylaw 7 c this is to notify you that the Commission will be holding a public hearing on proposed draft.

Podcast Apportionment Sourcing What You Need To Know Pkf Mueller

Pdf Formulary Apportionment And Group Taxation In The European Union Insights From The United States And Canada

Acct 4400 Salt 2 Apportionment Multijurisdictional Tax Issues Uses Of Local State Taxes Acct 570 Ch 12 State Local Taxes 4400 Multi Jurisdictional Tax State And Local Taxation Tax Law Test

Memorandum To Multistate Tax Commission

Proposed Amendments Would Change Apportionment Rules

The Multistate Tax Commission The Most Influential State Tax Policymaker You May Have Never Heard Of Andersen

Why States Should Adopt The Mtc Model For Federal Partnership Audits

Multistate Tax Commission With Helen Hecht Taxops

Eversheds Sutherland On Twitter Multistate Tax Commission Mtc Adopts Allocation And Apportionment Regulations Https T Co S0v1teel1x Tax Statetax Https T Co Vzxupukx4p Twitter

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Apportionment Using Market Based Sourcing Rules A State By State Review

Cooking With Salt Law Jones Walker Llp

Pdf Salt Useful Information Howard Hughes Academia Edu

Draft Workgroup Memo Multistate Tax Commission

Apportioning Income From Sales Of Services The Cpa Journal

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download

Vermont Clarifies Corporate Income Tax Apportionment Rules

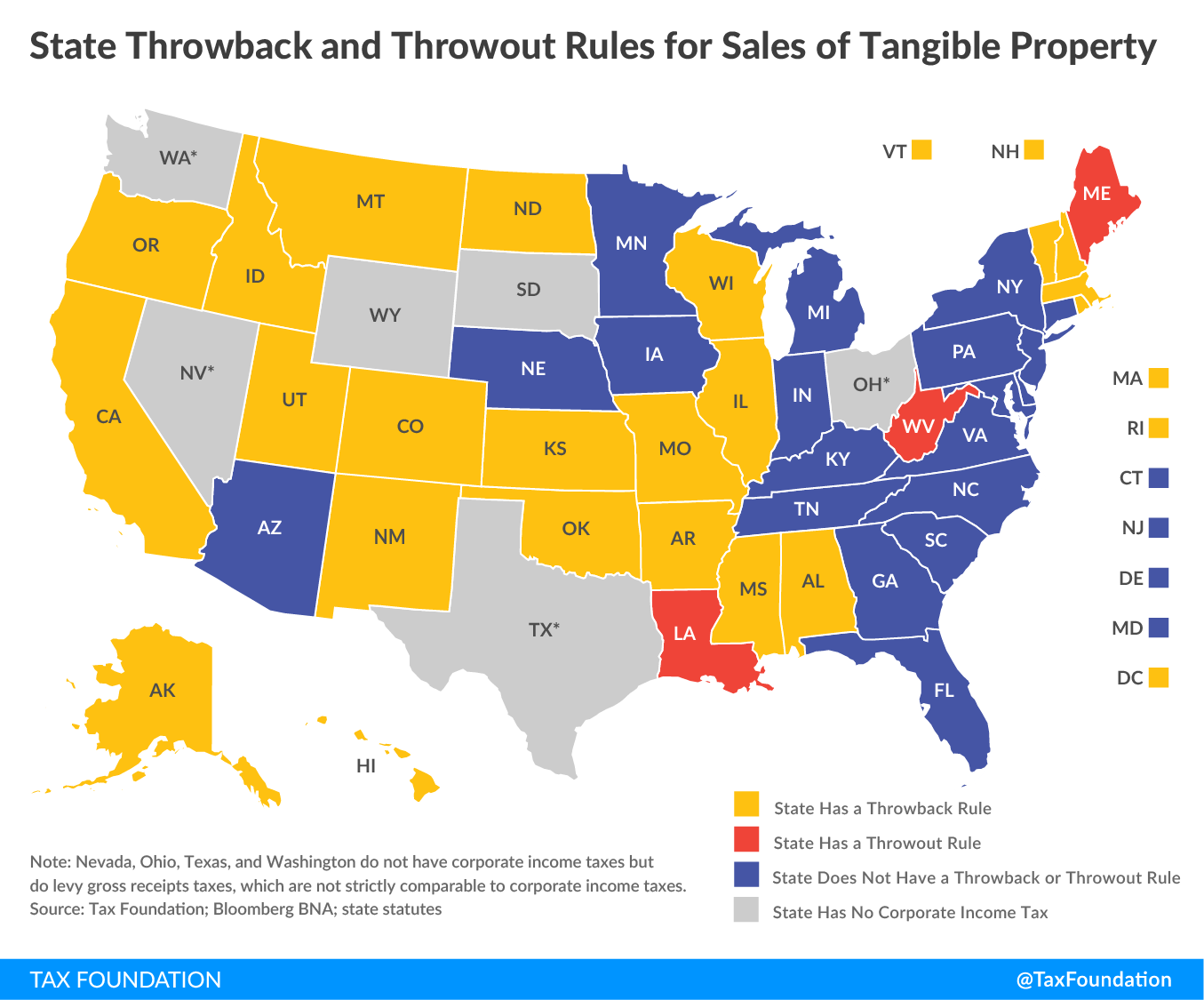

State Throwback Rules And Throwout Rules A Primer Tax Foundation